Covercy - Fixing real estate asset management

Covercy’s core commercial real estate asset management platform includes essential functions like an easy-to-use investor portal, tools to create and manage capital distributions and capital calls, a comprehensive view of investor analytics, and robust cybersecurity. Learn more below.

www.covercy.com

Execute distribution payments in a click, open a bank account instantly, and engage HNW & family office investors.

The managed real estate market continued to grow in 2020 to $10.5 trillion, despite a year of unprecedented challenges. It currently stands at 1.6 times the 2010 size. The real estate market’s convincing expansion in the face of the COVID-19 pandemic seems to underscore investors’ resolute search for returns across asset classes. And yet, investing in this market in a post-pandemic world may require some adjusting.

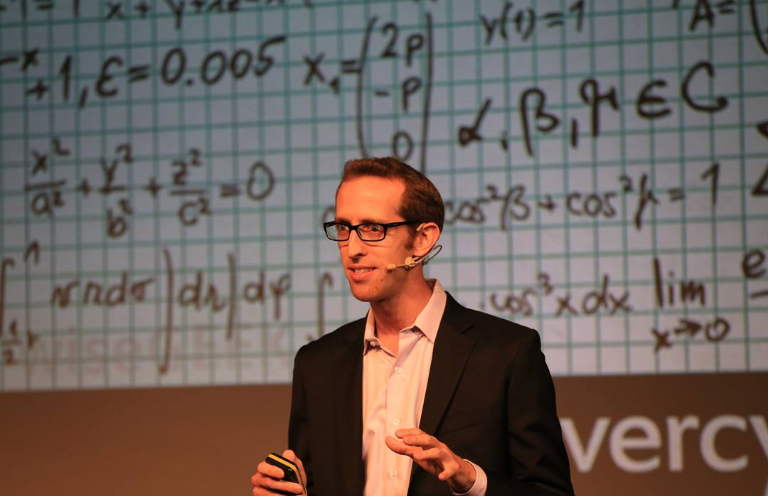

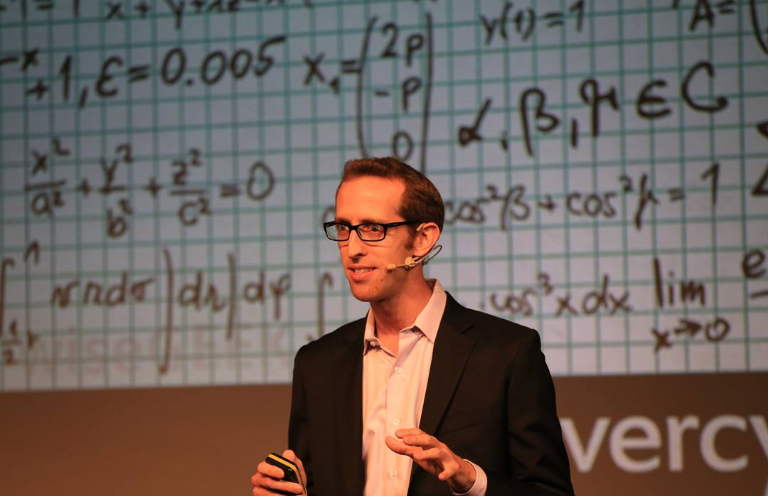

Covercy is a management platform with built-in financial services that helps commercial real estate investment firms grow assets under management and maintain critical efficiency. Doron Cohen is the Co-founder & CEO while Idan Hahn is CTO of the company. It is a real estate investment management software & banking platform for commercial real estate investment firms. GPs backed by high-net-worth investors use Covercy to streamline fundraising, delight investors, automate distribution payments, and more. The partners include Group 11, SILVERTECH VENTURE, ALTAIR Capital, and Microsoft ScaleUp.

The core tools include CRE investment core, distribution payments and automation, investor relations, and fundraising, which are needed to direct a real estate investment firm. In CRE investment core, one's Investors can access the account to view portfolio info, transactions, documents & reports. It enables one to create and manage capital distributions and capital calls. It allows one to view the positions of one's investors in all assets & funds. One can call capital in one's investment currency whereas Investors fund them in their select currency without the risk of phishing and wire fraud. For the required base product, one has to pay $100 a month.

Furthermore, for Distribution Payments & Automation feature, there is the auto-generated personalized distribution of notifications to each investor. Also, one can track their ownership by knowing who owns how much of each of one's assets and funds which are all auto-calculated. It manages one's current & potential investors. The company let complete all distribution of payments without any hassle with just one click and consequently debits that amount from one's account. It has the feature of Auto Pro-Rata Calculator which auto-calculates one's distribution for each investor. It Deducts taxes from each investor’s transactions and they are duly notified. The company's partner banks or payment partners will open accounts under one's fund/asset names to automate the processing of capital calls & distributions. The company makes sure to have strict money-laundering tests and policies which help one to stay acquiescent. It also includes Domestic and International distributions in which the company makes sure that one makes a bank transfer to an e-Fund account™ and autopay one's investors in their currency. The company also makes sure to notify its users if the distribution has any problem whatsoever. For this feature, one has to pay $75 asset/month.

For the feature of Investor Relations, the company entertains with Performance Reporting, Document Management, and Sharing, Investor Insights, and Integrated E-signature. The performance reporting includes published structured reports with professional metrics, text updates, and pictures. One can share documents like K1s, agreements, and financial statements with one's investor. It also includes complex investment structures comprising single-tier ownership or nested co-investments. For this feature, one has to pay $35 asset/month or $135 per fund per month.

The ACH distribution payment and receiving capital call payment are Free. The cross-border distribution payment is around $15 whereas the FedWire distribution payment is $5. The Currency exchange rate is variable whereas the Escrow account is minimal which is around $2500. One can talk to sales to learn more about fees in other currencies and currency exchange. Also, the Distribution fees and exchange rates are borne by the recipient. The company gives a live demo protecting and respecting one's privacy. It helps users learn how to Easily streamline one's investment firm’s operations, Automate fund distributions and empower one's HNW investors using the self-service investor portal.